franchise tax bd co

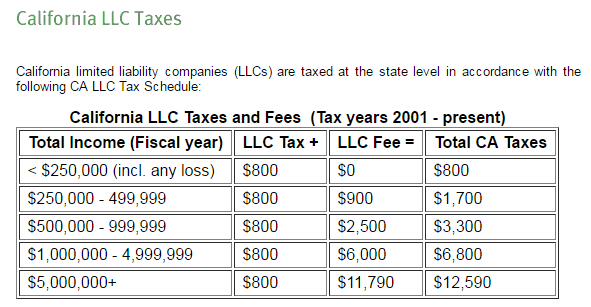

For LLCs the franchise tax is 800. Appeals of Sterling Finance Corp.

There are 7222 searches per month from people that come from terms like franchise tax bo or similar.

. Feb 11 1983 Feb 11 1983. Unity of Apportioning Pass-through Entities. A State Tax Refund is taxable if you itemized deductions on that prior years federal return and took a deduction for state income taxes instead of the sale tax.

Thus in 1993 the Board launched an audit to determine whether Hyatt underpaid his 1991 and 1992 state income taxes by misrepresenting his residency. Ad BBB A Top Rated Tax Defense Company. Appellee Construction Laborers Vacation Trust for Southern California CLVT was established by an agreement between construction industry employer associations and a labor union to provide a mechanism for administering.

LEGAL RULING 2021-01 SUBJECT. 139 CalApp3d 843 189 CalRptr. Petitioner Franchise Tax Board of California Board the state agency responsible for assessing personal income tax suspected that Hyatts move was a sham.

Capital and surplus Marble Mortgage Co. The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version as of the date of certification published by the Web. Franchise Tax Bd supra 10 CalApp3d at p.

Did you take the Standard Deduction on your 2019 Federal return. And Honolulu Oil Corp. ISSUE Whether in a series of differing situations pass-through entity holding companies are unitary with.

545 386 P2d 33. FRANCHISE-TAX-BO-PAYMENTS has been in the DB for a while it is the number 23352. I remember filing my tax return for 2015 and I had paid right on the money to CA I think I was owed a dollar or two back so.

The franchise tax is impressed annually on corporations for the privilege of exercising the corporate franchise within California. Appellant Franchise Tax Board appeals from a judgment granting refund of corporate franchise taxes paid for income years 1972 220 Cal. Tax using either combined reporting or separate reporting while corporations engaged in a unitary business within and without California After briefing on the cross-motions was completed the trial court stayed the proceeding until the Fourth District decided Harley-Davidson Inc.

It says FRANCHISE TAX BD DESCASTTAXRFD which google slething tells me is a CA state tax refund. 3d 457 Brought to you by Free Law Project a non-profit dedicated to creating high quality open legal information. FIRESTONE TIRE RUBBER CO Court of Appeal of California Second District Division Four.

CaseIQ TM AI Recommendations FRANCHISE TAX BD. It comes from Panama. Please contact the moderators of this subreddit if you have any questions or concerns.

Franchise Tax Board supra. Appeal of Winter Mortgage Co Cal. Issued and whether the information sought is reasonably relevant to the duties of and intended investigation by the Tax Board see Union Pac.

Franchise Tax Bd 463 U. In California the franchise tax rate for S corporations is the greater of either 800 or 15 of the corporations net income. 14 A130803 FRANCHISE TAX BOARD San Francisco County Defendant and Respondent.

3d 892 through 1975 by respondent Mole-Richardson Company. W-4 IRS Withholding Calculator. IN THE SUPREME COURT OF CALIFORNIA.

In Hyatt the Supreme Court focused on the issue of whether the Full Faith and Credit Clause of the federal constitution required Nevada to afford FTB the benefit of the full immunity that California provides FTB. Franchise Tax Board 1963 60 Cal2d 406 413 34 CalRptr. I am a bot and this action was performed automatically.

504 Given that Castle executives made up the entire Hy-Alloy board of directors Castle was effectively able to control Hy-Alloy at least with respect to major policy. LABORERS VACATION TRUST1983 No. Code 23151 fn.

502 Unity of use refers primarily to the integration and control of executive forces. FRANCHISE TAX BD CASTTAXRFD 022117 XXXXX5 1600 022417 Is this something from my tax return. Technically I shouldnt have been guilty and I am fighting for it.

The question presented is whether under the factual circumstances of this case the activities of a corporation with diverse business enterprises carried on both within. Chase Brass Copper Co. 1683 155 LEd2d 702 2003.

Opinion for Chase Brass Copper Co. FIRESTONE TIRE RUBBER CO. THE GILLETTE COMPANY et al Plaintiffs and Appellants S206587 v.

Franchise Tax Board 1963 60 Cal2d 417 425 34 CalRptr. Franchise Tax Bd. 4 whether if the corporation is engaged in lending activity the loans are significant in number and amount The Morris Plan Co.

April 19 1983 Decided. The measure of the tax is limited to income reasonably attributable to sources in California. Franchise Tax Bd 138 Cal.

United States Supreme Court. 2015 237 CalApp4th 193 Harley I. FRANCHISE TAX BOARD Legal Division MS A260 PO Box 1720 Rancho Cordova CA 95741-1720.

Just checked my bank account and apparently on 9916 I had several hundred dollars deposited into my account. This also happened to me. Of Equalization 49 Cal 3d 138 146-147 776 P2d.

Moreover the clause is only exacting in its requirements where judgments are concerned see Franchise Tax Bd. We May Lower Your FTB Balance and Get You A Better Outcome. Although Californias statute does not directly impose a tax on nonunitary income it measures the amount of additional unitary income that becomes subject to its taxation through reducing the deduction by precisely the amount of nonunitary income that the taxpayer has received.

The fact that the court has restricted the boards discretion to apply separate accounting rather than allocation under the unitary business rule see Superior Oil Co. I have a traffic ticket which I extended the court date 3 months later.

California Franchise Tax Board Linkedin

California Ftb Rjs Law Tax Attorney San Diego

What Does Legal Order Debit Franchise Tax Board Mean Larson Tax Relief

The Limits Of Nudging Why Can T California Get People To Take Free Money Planet Money Npr

California Franchise Tax Board Bank Levy How To Release And Resolve Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

How To Pay Ca Franchise Tax Board Taxes Landmark Tax Group

California Franchise Tax Board Taking Tax Refunds With No Notice Cbs Sacramento

![]()

Ca Franchise Tax Board Sf Business Portal

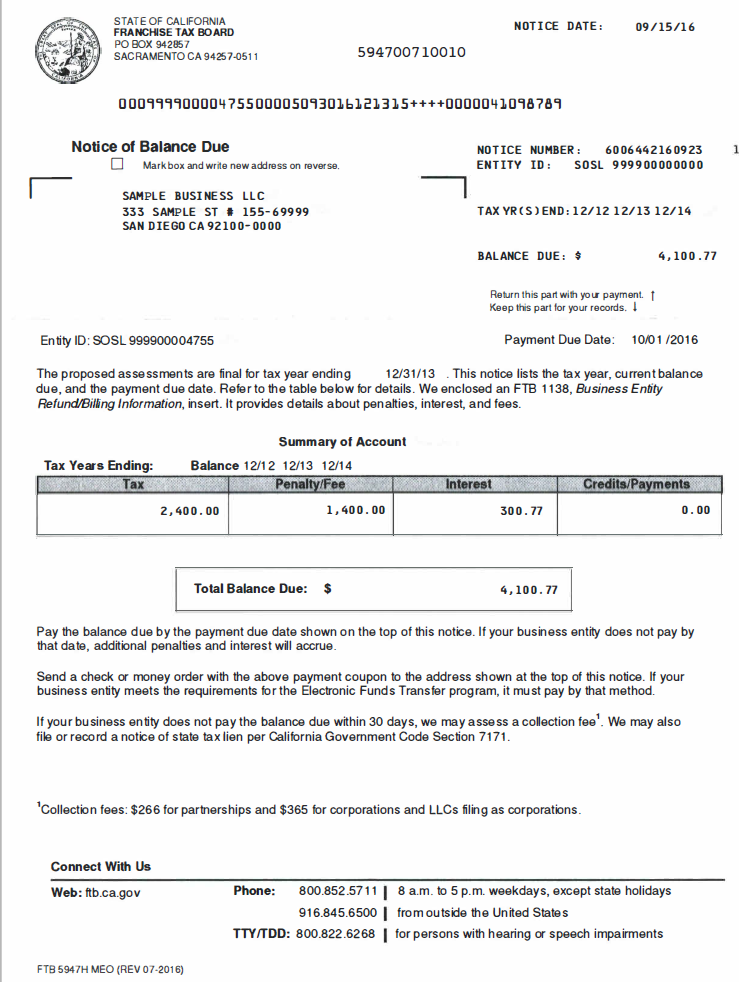

Ftb Notice Of Balance Due For Llcs Dimov Tax Cpa Services

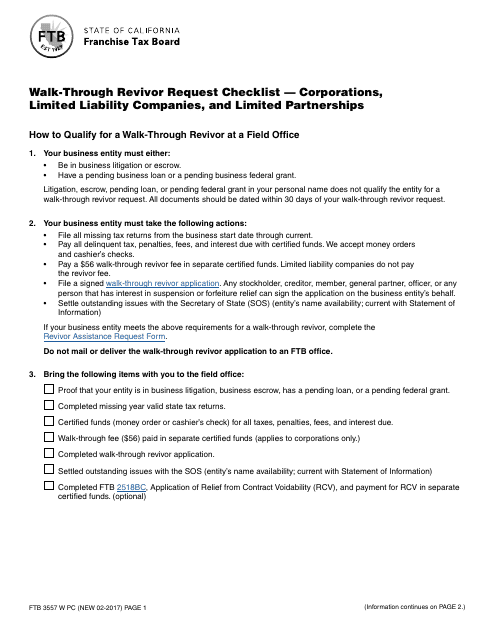

Form Ftb3557 W Pc Download Fillable Pdf Or Fill Online Walk Through Revivor Request Checklist Corporations Limited Liability Companies And Limited Partnerships California Templateroller

Ftb Notice Of Balance Due For Llcs Dimov Tax Cpa Services

Getting A Phone Call From The Ftb Lsl Cpas

California Franchise Tax Board Taking Tax Refunds With No Notice Cbs Sacramento